Adobe Stock: #210317522

Gas Infrastructure Europe reported in early October 2023 that 95.99% of its gas storage facilities were filled, surpassing last winter’s peak. What’s more, the result was achieved a month and a half earlier than in the 2022-23 winter season. However, it would be premature to celebrate the success of the European energy sector, since Russian gas supplies might not prove easy to replace in the long run.

To start with, the impressive results above are largely due to the unusually warm winter of 2022-23. By the end of March 2023, storage sites were 56% full, while in 2022 summer re-filling started from a more typical 26% capacity.

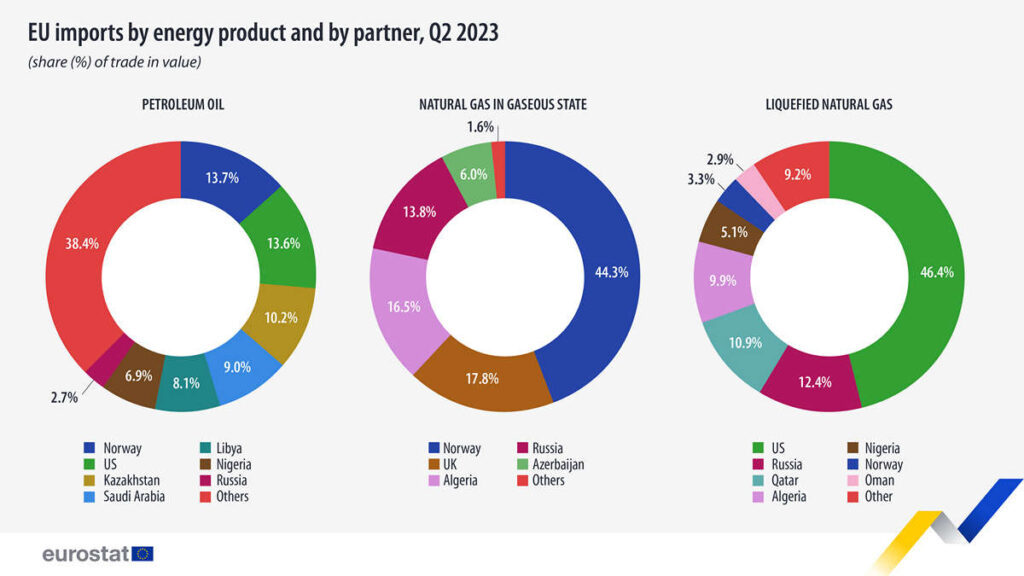

Actual gas imports in 2023 have decreased compared to the 2022 level. In Q2, for instance, total gas supplies dropped by 17% compared to the previous year, according to Eurostat https://ec.europa.eu/eurostat/web/products-eurostat-news/w/ddn-20230925-1#:~:text=Natural%20gas%20imports%20from%20Russia,the%20second%20quarter%20of%202023 . The drop was caused in large part by the switch from Russian gas imports. The process is developing fast: import volumes more than halved from Q4 of 2022 to Q2 of 2023, from a monthly average of 5.1 million tonnes to 2.5 million tonnes. While some countries increased their volume of supplies to the EU, these failed to replace Russia’s lost contribution – especially if Russian LNG shipments are added to the picture. “In the first quarter of 2023, Russian LNG made up 20% of total natural gas imports to Spain and Portugal. If all Russian LNG imports to the region were to end and nothing else changed, gas storage would run dry by January 2024”, wrote Ben McWilliams, Affiliate fellow with European think-tank Bruegel on October 10.

Norway, the EU’s current top gas supplier with a market share of 44.3%, delivers gas mainly via a network of subsea pipelines. In 2022, 116.9 bcm out of some 120 bcm of gas delivered to Europe and Britain was transferred through pipelines, while the remaining 3% came as LNG. Under pressure from the loss of Russian gas in 2022, a new route was launched: Baltic Pipe, a spur of Europipe II, has connected Norwegian suppliers with the Nybro terminal on the Danish west coast. The new branch now carries some 10 bcm of natural gas per year.

However, any further growth is uncertain. While government and industry heavyweights are willing to proceed, all existing sites are running at full blast, and any new projects will need time for development – something that Europe lacks. According to Norway’s Petroleum and Energy Minister Terje Aasland, the best his country can offer Europe is a stable level of gas supplies through to 2030. Whether the situation will change, leading to a growth in Norway’s output that will be more favourable for Europe, remains doubtful. Any significant upstream or midstream project in the country is vulnerable to a strong left-wing opposition backed by green parties and activists.

Prospects with other pipeline suppliers are not rosy either. In 2021 Algeria promised to increase its contribution to the EU energy sector by the end of 2022, but in fact supplies fell from 50 bcm to 44 bcm over this period. Although growth has been observed in 2023 and the annual surplus could reach 7 bcm, technical issues within the European gas delivery system may become an obstacle. Spain, which receives the African piped gas, has a limited transport capacity to the rest of Europe. The pipeline connecting Spain and France can deliver as much as 5.5 bcm per year working at 71% capacity. Meanwhile, France alone consumes between 36 and 44 bcm of gas per year.

Adobe Stock: #493131345

With Russian natural gas gone (or disappearing from the picture), the main natural gas suppliers are now Norway, Great Britain and Algeria, which between them account for more than 78% of total natural gas imports.

In order to maintain a balance, back in 2022 the EU introduced the Joint Natural Gas Tender Platform (or EU Energy Platform https://energy.ec.europa.eu/topics/energy-security/eu-energy-platform_en ), which aims to monopolize the purchase process so that no individual country can bypass the agreement to drop Russian supplies. However, not all EU member states are thrilled at the prospect. On an official visit to Moscow in April 2023, Hungary’s Foreign Minister Peter Szijjarto stated that energy cooperation with Russia was a matter of national security for his country. “As long as the issue of energy supply is a physical issue and not a political or ideological one, like it or not, Russia and cooperation with Russia will remain crucial for Hungary’s energy security,” he said. Later this year Alfred Stern, chief executive of the Austrian energy company OMV Group, also stated that Austria is willing to buy Russian gas if Russia is selling it. A long negotiation process to resolve the controversy lies ahead, but in the meantime nothing is certain.

LNG will not fill the void either. Technical reasons include considerable losses (compared to pipeline supplies) of 1-2%, due to evaporation and a limited LNG tanker fleet. The overall capacity of the entire global LNG fleet is around 100 bcm. This means that in order to satisfy the EU’s needs, each tanker would need to bring its cargo to European terminals twice.

In fact, competition among LNG importers is intensifying, which is driving prices up. The US, the world’s leading LNG exporter and a major supplier to the EU, has long-standing commitments and is unable to increase its supplies overnight, since 70% of its production worldwide is operating under long-term obligations.

The majority of LNG deals with European partners signed since 2018, after the EU and US signed a framework trade deal, won’t come into force until the mid-2020s. Although the European Commission identified switching to the US as its main gas supplier as an objective back in 2018 https://energy.ec.europa.eu/system/files/2022-02/EU-US_LNG_2022_2.pdf , this won’t happen soon. “The European gas market – and by extension the global gas market – [is] certainly not out of the woods in terms of adequately matching supply with demand,” Tom Marzec-Manser, Head of Gas Analytics at ICIS, was quoted as saying by CNN https://www.cnn.com/2023/06/16/energy/european-gas-price-rises/index.html .

For now, American LNG imports to Europe are closely followed by those from Russia. As of 2022, Russian LNG was shipped to France, Spain, Belgium, and the Netherlands, costing these countries considerably more than pipeline supplies.

If the issue of a long-term gas shortage remains unresolved, a further increase in tariffs won’t be long in coming. In fact, average gas prices in Europe have grown from €8.6 per 100 kWh in the first half of 2022 to €11.9 per 100 kWh in the same period of 2023 according to Eurostat. Such matters could easily lead to popular discontent with EU leaders and require further actions to deal with potential energy shortages.