German Chancellor Friedrich Merz’s visit to Qatar in February 2026 was more than just a bilateral meeting. It is part of a broader European Union strategy to diversify LNG supplies. Against the backdrop of increasing dependence on American LNG and growing unpredictability in Washington, Berlin and Brussels are trying to make their energy supply more stable. In this context, Qatar is considered one of the world’s most important gas producers and exporters and a strategically important partner.

Qatar Expands Its Energy Footprint in Europe

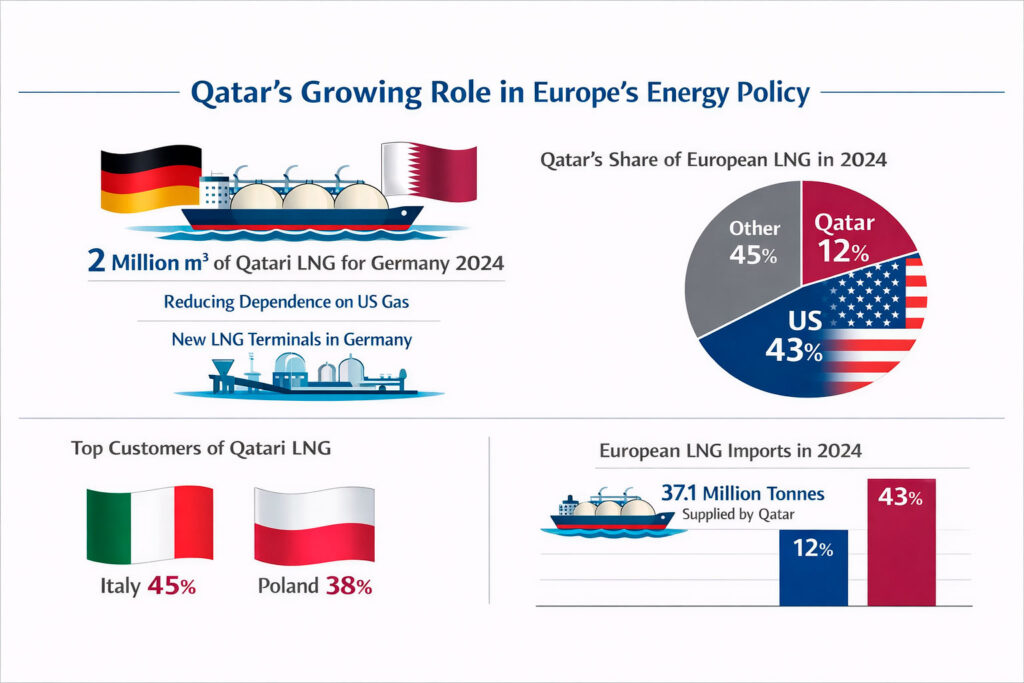

A key topic of the talks between Merz and representatives of Qatar was LNG supplies. Germany wants to expand its circle of suppliers and reduce the share of American gas in its energy balance. Around two million cubic metres of Qatari LNG are planned for Germany this year. That is not much by European standards, but it is politically significant. Until now, Germany has been dependent on pipeline gas. It was only after the energy crisis of 2022 that the accelerated construction of terminals began.

Other European countries, on the other hand, have long since established more stable relations with Doha. Qatar is already an important gas supplier to the EU. According to Kpler, an analysis company specializing in commodity trade data, the emirate covered between 12 and 14 per cent of European LNG demand in 2024 and supplied around 37.1 million tonnes to the Union. According to estimates by Deutsche Welle, Qatar’s share of European LNG imports was around 12 per cent, while the US accounted for 43 per cent.

Italy and Poland remain the largest consumers of Qatari gas in Europe. Qatar accounts for around 45 per cent of Italy’s LNG imports and around 38 per cent of Poland’s. These countries signed long-term contracts much earlier than Germany and have the infrastructure to receive and regasify the gas.

Diversification as a Pillar of Political Strategy

With the EU’s growing dependence on American LNG, diversification has once again become a major focus. Formally speaking, the US remains Europe’s largest gas supplier. However, there is growing concern in Brussels that too much concentration on a single source poses strategic risks.

Dan Jørgensen, head of the European Union’s energy department, said the Union is increasingly concerned about its dependence on American liquefied natural gas, especially in light of President Donald Trump’s harsh rhetoric. This includes his comments about a possible review of trade relations and threats against allies. This reinforces fears that energy supplies could be used as a political lever.

The EU has therefore intensified talks with alternative suppliers such as Qatar and Canada. The aim is not to do without American gas, but to create a more balanced import system without the dominant position of a single partner.

In this sense, Qatar appears to be an attractive option. The LNG market in Europe remains tense and, according to analysts, will remain so for at least the next three years. If global LNG demand does indeed rise to over 600 million tonnes per year by 2030, the expansion of Qatar’s North Field could significantly strengthen the emirate’s position in Europe. Industry analysts expect Doha to almost double its capacity after 2030. Europe is considered one of the most important markets for these additional volumes.

The Complexity of Long-Term Energy Contracts

However, closer cooperation with Qatar faces structural hurdles. The most important of these concerns contract models.

LNG suppliers from the Gulf states – including Qatar – generally insist on long-term contracts with terms of at least 20 years. This is due to the high investment costs: production, terminals and infrastructure cost billions. Without long-term commitments, many projects are less profitable.

This presents a dilemma for the EU. On the one hand, long-term contracts ensure security of supply. On the other hand, they conflict with the Union’s climate targets and plans to gradually reduce fossil fuel consumption.

Claudia Kemfert, head of the Department of Energy, Transport and Environment at the German Institute for Economic Research (DIW) puts it this way:

“A stronger focus on the Gulf states may formally reduce dependence on US LNG, but it does not automatically lead to greater energy security.”

She warns against new geopolitical dependencies and so-called “fossil lock-in effects”. These make it more difficult to switch to renewable energies more quickly because they favour long-term investments in gas infrastructure. In addition, LNG is naturally one of the most expensive fuels.

“Liquefaction, transport and regasification are energy-intensive processes – LNG remains more expensive than other fuels in the long term.”

Last year, an EU directive was also passed that requires large companies to check their global supply chains for human rights and environmental standards. Even though the directive is not due to come into force until 2028, the requirements are already shaping negotiations.

If Qatar considers European regulations to be too burdensome, the emirate could divert additional volumes to Asia. Demand is growing faster there – and the regulatory burden is lower.

Energy Markets Under Geopolitical Pressure

Regional instability must not be ignored either. Although the expansion of Qatar’s North Field West field may increase its export opportunities, the security risks in the Middle East, for example around the Strait of Hormuz and in the Red Sea, remain a key issue for European buyers.

In addition, closer cooperation with countries in the Persian Gulf inevitably raises questions about the moral standards of energy policy. Thomas Geisel, former head of Gas Purchasing at Ruhrgas/E.ON Ruhrgas, says:

“If you have ended Russian gas imports on moral grounds, it is morally difficult to explain why you now want to buy LNG from Qatar or Saudi Arabia.”

Return to Doha

Against this backdrop, the symbolic and strategic importance of Friedrich Merz’s visit to Qatar cannot be overstated. In line with Europe’s policy of broadening energy relations and reducing dependencies, Germany would like to deepen its partnership with Qatar and open up additional supply options. Like other EU countries, Berlin must balance security of supply, price stability and climate targets.

A key issue is long-term contracts that are compatible with EU climate policy, for example through flexible terms, adjustment clauses or a gradual transition to more climate-friendly energy sources. Added to this are geopolitical uncertainties and competition with Asian markets for future LNG volumes. This is precisely why reliable framework conditions, coordinated European demand and partnership-based relationships are becoming increasingly important, as they increase Europe’s room for manoeuvre and strengthen the resilience of its energy supply.

Europe is working to make its energy supply broader and more independent in the long term, thus making it more crisis-proof. The key is not to switch from one main supplier to another, but to maintain a balanced mix of partners, routes and contract models. The visit to Doha was another step in this direction, strengthening the EU’s foreign policy capacity and opening up additional options for Member States. Although diversification remains challenging and requires careful coordination, it increases Europe’s scope for action and thus improves overall energy security.