Venezuela’s recent political upheaval has triggered renewed attention in global energy markets, but oil prices remain muted, with Brent crude trading around $60 per barrel. According to analysts, this muted reaction reflects broader supply conditions rather than a lack of concern about Venezuelan instability.

Political Earthquake, Limited Price Reaction

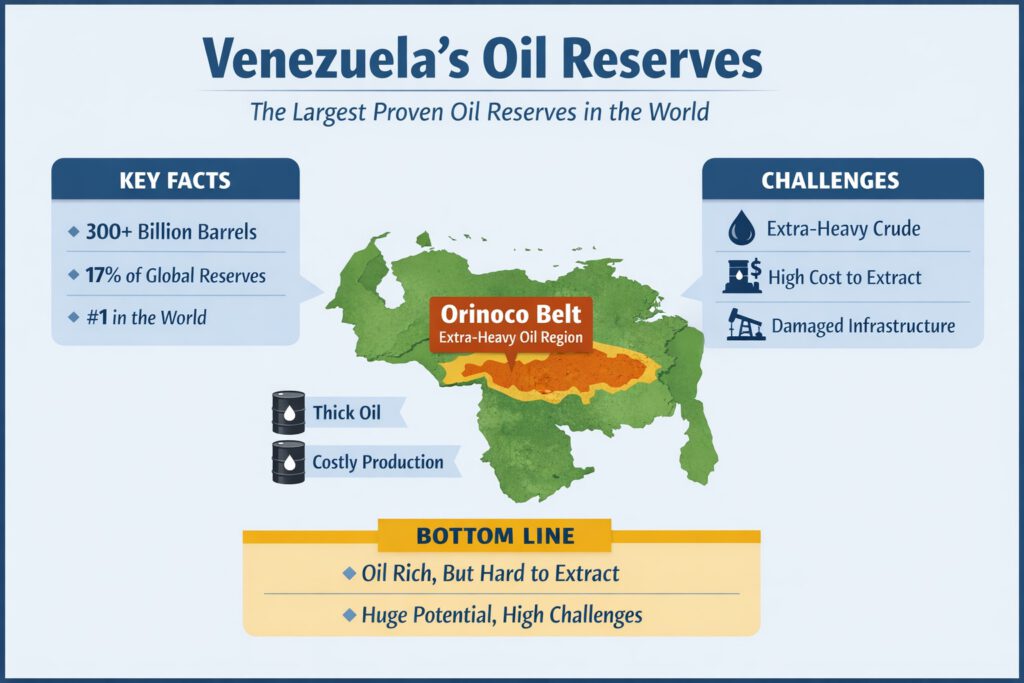

The U.S. military’s operation to capture Venezuelan President Nicolás Maduro thrust the nation into geopolitical headlines. Venezuela has the world’s largest known oil reserves, with approximately 303 billion barrels, or around 17–18% of total global reserves. However, its production has dwindled sharply due to long-term underinvestment, sanctions and infrastructure decay.

Even when prices wavered briefly after news of the intervention, markets quickly stabilized. Many market strategists, including Simon Wong, portfolio manager at Gabelli Funds, argue that while news can trigger short‑term volatility, oil prices over time are driven more by fundamentals than by day‑to‑day headlines.

Energy analysts confirm that Venezuela’s role in global supply has shrunk to a fraction of the market, with production under 1% of worldwide output – one reason traders have treated the latest turmoil as a headline risk rather than a fundamental shock. Global oil production is currently over 100 million barrels per day (roughly 105-107 million barrels per day, depending on the year and source. In market terms, anything below 1% of global production is considered structurally small, which explains why disruptions or political shocks in Venezuela currently have limited impact on global oil prices compared with developments in major producers such as the U.S., Saudi Arabia, or Russia.

Venezuela currently accounts for only a small fraction of global oil supply, and analysts say a meaningful increase is unlikely in the near term given the scale of repair and investment required. That means disruptions there are far less influential than they once were. Noah Barrett, research analyst at Janus Henderson (“Venezuela: Implications for oil and the energy sector”), explains:

“Oil markets have remained relatively calm because Venezuela’s reduced role in global supply and an already well-supplied global market dampen the near-term price impact from geopolitical shocks.”

Ample Global Supply and Price Pressure

Markets have remained calm largely because production from other regions – including the United States, Brazil, Guyana, and Argentina – continues to grow. At the same time, OPEC+ producers have unwound output cuts, keeping global supply abundant and contributing to a projected surplus in 2026.

Oil markets, which are now more developed, already reflect expected supply increases from various producers as well as any additional barrels that might come from Venezuela, so any upside in prices is likely to be limited, notes Martijn Rats, global commodity strategist at Morgan Stanley.

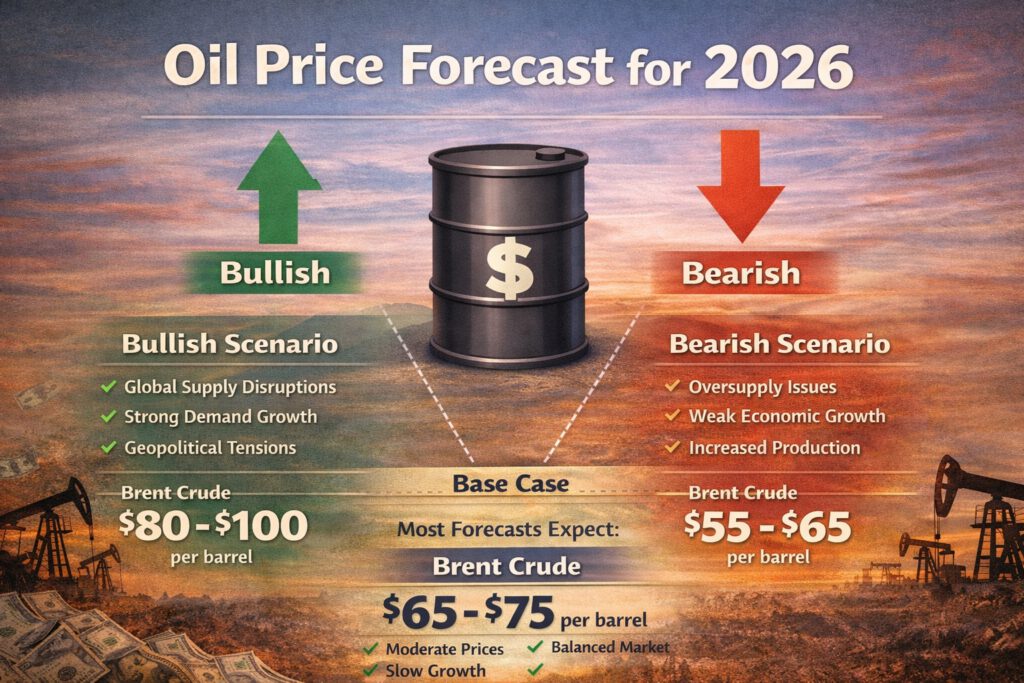

“In that scenario, we estimate that Brent prices may need to fall into the mid-$50s to create the necessary supply slowdown.” Meaning that brent could test the mid-$50s in a more bearish scenario if oversupply persists and demand weakens.

Tripling Venezuela’s current output would require more than a decade

Looking ahead, analysts caution that restoring Venezuela’s oil output will take years and vast investment. Even optimistic scenarios suggest that Venezuelan production may gradually increase — but not quickly enough to change the global price picture in 2026.

As one industry expert put it:

“The ultimate impact on oil prices hinges on whether Venezuela can attract sustained foreign investment and rebuild its oil infrastructure – a process measured in years, not months.”

The Council on Foreign Relations notes that “the full restoration of Venezuela’s oil production and revenues will take years and many billions of dollars,” and that returning toward past output levels would likely require on the order of 10 years and around 100-180 billion dollars in investment. Any production gains in the next couple of years are expected to be modest, not price‑changing in 2026

Analysts say only a few hundred thousand barrels per day can realistically be added in the near term, and that markets should “plan for delayed Venezuela recovery through 2026,”.

Energy strategists generally expect oil prices to stay range-bound unless there’s a major supply shock. Their baseline view is that strong non-OPEC supply growth and the ongoing impact of OPEC+ policy decisions will keep the market well supplied, limiting sustained upside – even if Venezuela remains politically volatile. In this setup, experts see Venezuela as a headline-driven risk factor (capable of causing short spikes or dips), but not yet a structural driver of higher prices until investment, infrastructure repairs, and export capacity translate into material, reliable barrels on the market.

Conclusion: When Oil Ignores the Headlines

Energy analysts agree that Venezuela’s political upheaval is important – particularly for how the country may re-enter the market over time – but they say it is not the dominant driver of prices right now. With global supply still rising and the market widely seen as well stocked, the current surplus is doing more to shape crude than near-term geopolitical headlines. For now, most forecasters expect oil to trade in a relatively moderate range, with any moves likely to be incremental unless there is a sharp shift in global demand or a major disruption to supply elsewhere.